Top Tips on Getting Money Back with the R&D Tax Incentive

A question I am frequently asked in the aftermath of each financial year is 'can you help me put together my R&D Tax Assessment?'. Unfortunately, the short answer is no. Your R&D (Research and development) tax incentive application shouldn't be reverse engineered. The incentive has been designed by the government to encourage the forward planning of your business and so requires extensive evidence of your research process to obtain it. This includes information about how much you spent, what it was spent on and why.

Therefore the help I can instead offer is advice on how to structure your tech business so that it is not only helping your business model but also fits the requirements needed to receive the benefits of the R&D tax incentive. This process can help you document and gather the evidence in a forward planning context. At WorkingMouse we are able to do this documentation for you. We have a wiki for each of our partners and we put all of the documentation and evidence in this location so that you can use it as part of your submission.

The R&D tax incentive is offered each year to encourage companies to participate in research and development within Australia by reducing the financial risks involved with experimentation and innovation. This incentive is particularly beneficial for startups because all business earning under $20 million will receive 45% of their expenditure on research and development back. Considering on average a whopping $1.8 billion is being given out to tech companies each year, if you are innovating there is no reason why your business should be missing out.

However, there are stringent requirements to meet in your application. The ATO has recently warned about startups incorrectly claiming R&D on ineligible activities. "Startups should ensure that activities are generating new knowledge or undertaking experimentation of new technologies; that the technical uncertainty being addressed by the activity is clearly identified; and that the activities claimed are directly related to supporting experimental activities.".

So how can you ensure your business activities are applicable? My first suggestion would be to follow the scientific process. Activities are often incorrectly claimed as R&D because the process of developing software is by nature iterative and cyclical, which can deceptively appear to equate to 'research and development'. However, the distinctive difference is that the R&D tax incentive applies to projects solving technical issues outside of existing knowledge. The advantage of completing your project using the scientific process is that you can clearly identify where your business development differs from others.

The scientific process follows the method of coming up with a hypothesis, gathering information, testing, collecting data, and coming to a conclusion on the outcome. An example of a hypothesis statement could look like:

The name of this test is ______________________ (test name)

It will begin on __/__/__ and finish on __/__/__ (test dates)

It will cost ______________________ (resources & money)

We believe that ______________________ (the solution) ______________________ (to these people) will result in ______________________ (this outcome)

We will do this by ____________________________________________ (data collection)

We will know we are successful when ____________________________________________ (signal from the market)

Particularly during the beginning of the process where you are formulating your hypothesis, it becomes clear where your business is diverging from others. Having to make a prediction about the results of your tests, because thorough research has not identified the results with any clear level of certainty, demonstrates that you are meeting the R&D requirement of conducting research in an area of uncertainty in your field. These hypothesis statements are additionally valuable at the finish of the test to compare your †outcome' prediction with whether you achieved you †signal from the market'. This reflection is an important step of the scientific process because you are then able to additionally identify for your R&D application, your learnings from the experiment.

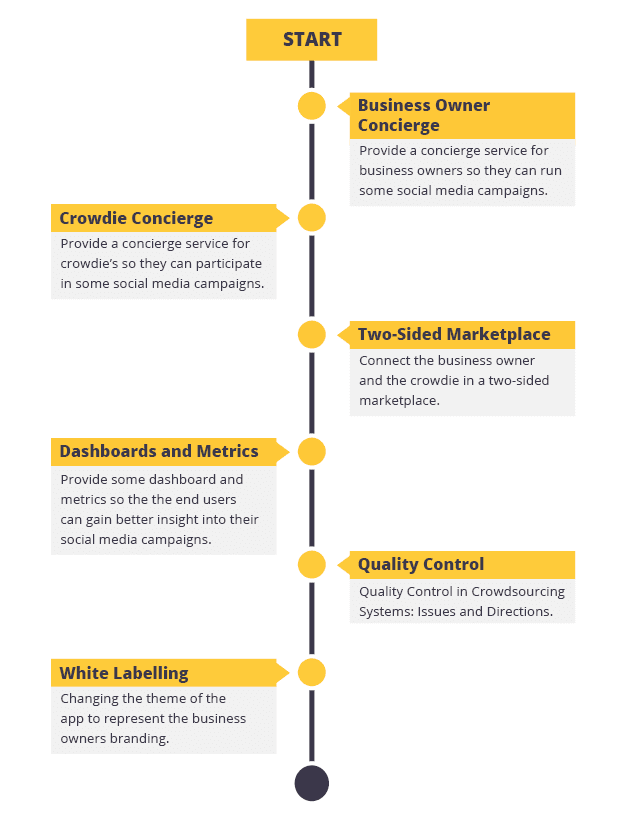

The second business tool I would recommend utilising is to start roadmapping each experiment before you begin. Roadmaps are where you create a high level vision with your team of where the project is going. You can see an example of one of WorkingMouse's mockup roadmaps below. Creating these will allow you to identify which specific activities or processes contribute to the research and development. The ATO identified that a large amount of startups were incorrectly including whole projects as research and development, whereas the guidelines clearly state that each activity contributing to a project must be individually considered. The roadmap is an important tool for both your business and the auditor to visualise the significance of each activity in contributing to the R&D results.

.png)