.png)

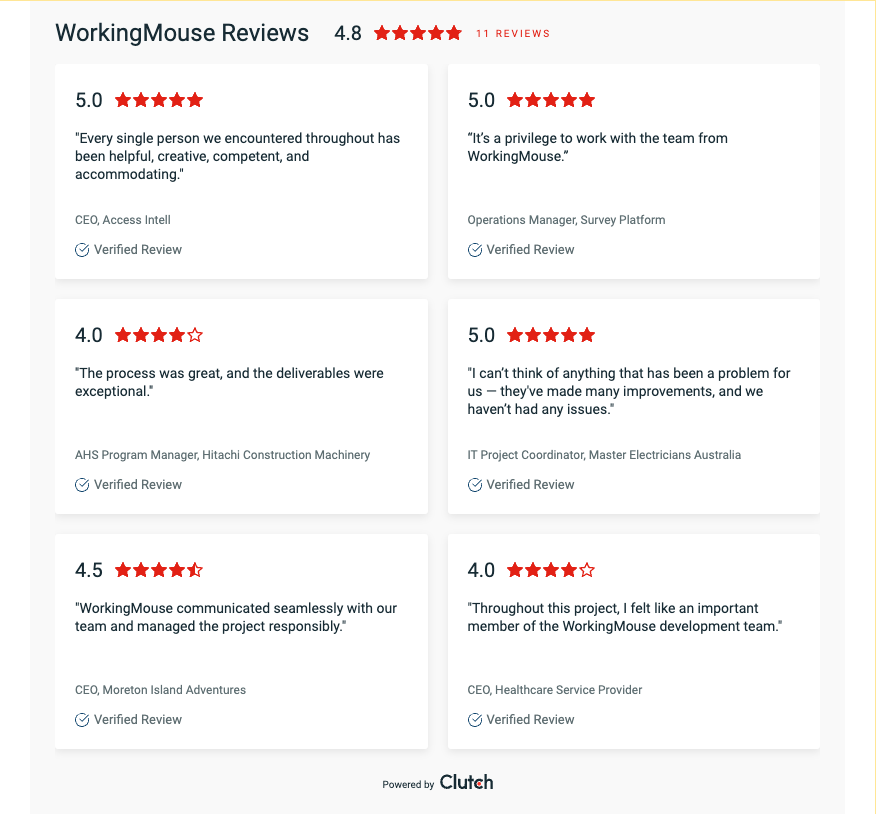

How We Can Help

WorkingMouse empowers government departments and enterprises by Discovering, Modernising, and Optimising software systems.

Here are some example project types where we take your problem and find a solution.

Modernisation of Legacy Systems

Modernising legacy systems enhances security, performance, and facilitates business process optimisation. WorkingMouse specialises in 'like-for-like' modernisation, which reduces project risk by preserving the core business process and logic. This approach allows you to take control of an upgraded system without changing your existing business operations.

Elevating Constrained Systems

WorkingMouse converts manual processes, spreadsheets, and offline databases into integrated digital solutions. This not only boosts productivity and data accuracy but also grants enhanced control over systems and data, facilitating seamless interaction with other systems.

Connecting Disparate Systems

WorkingMouse integrates varied systems, often found operating in silos within government departments. Our solutions ensure seamless data flow, enhancing control and facilitating informed decision-making.

.png)